Stock trading is a major trend among the people of Nanliu, a tiny village in northern China’s Shaanxi province. Lots of locals – even farmers – have preferred trading over their traditional jobs, earning the Nanliu the nickname ‘China’s stock trading village’.

Many of them made big profits this spring, thanks to China’s stock market hitting a seven-year high, and this inspired more from the community to come forward with their money. “It’s a lot easier to make money from stocks than farm work,” said apple farmer Liu Jianguo, who invested $8,000 into the Shanghai Composite.

That’s a huge chunk of his savings, but he was willing to take the risk. “It’s risky, you can earn $16,000 in ten minutes, and lose it all in the next. I’ve made some small profit and gained experience but I still feel anxious when my investments aren’t doing well.”

Photo: Chinasmack.com/Getty Images

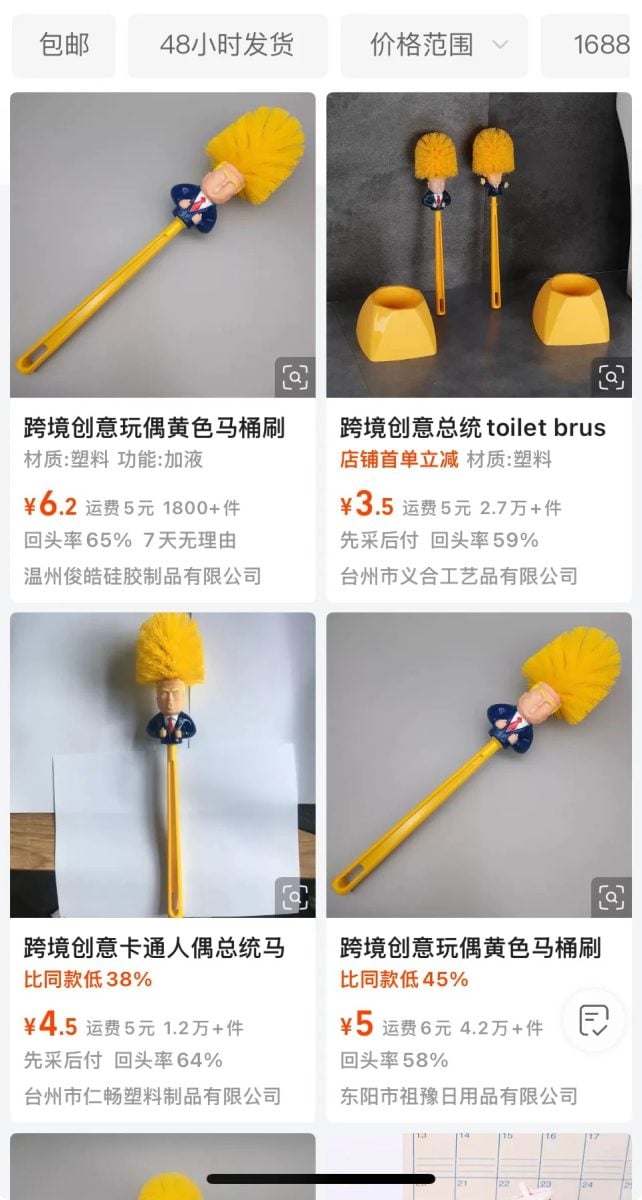

The villagers apparently caught stock trading fever after hearing about it from a nearby town. They heard about how people were making big money fast, and the excitement spread rather quickly. Pretty soon an informal stock market center was set up in the village chief’s courtyard home, where villagers got together to monitor their investments closely. They used computers and smartphones to keep themselves updated with latest marketplace developments. The rhythm of the market was apparently perfect for village life – farmers would tend to their fields early in the morning and gather at the center to follow market action every afternoon, only to leave after the close. And they would meet again after sunset to discuss economic developments in the nation.

Soon, locals came to be recognised by how much money they made trading stocks. Wang Li, a grocer by profession, became a popular figure in the community after she struck gold with a whopping $33,000. That’s about 40 times her initial $820 investment in 2010. She was considered an expert of sorts – villagers regularly went to her for advice on trading, and she would tell them to keep an eye on the nation’s economic developments and government policies.

Photo: Xinhua/Liu Xiao

Nanliu is not the only village in China that was hit by the investment craze. Residents of many other rural areas pooled their money into stocks, thanks to the Shanghai Composite rally rising by 110 percent since last November. Many of them were considered financially literate – China ranked first in the investment component of the MasterCard Financial Literacy Index Report in April.

Sadly, things went a little downhill after June this year, just as experts feared – the stock market bubble burst and many farmers ended up losing their money. The frenzy of borrowing and buying has finally died down, and what was described as “just the beginning” of the bull run when the benchmark index hit 4,000 points retreated rather quickly. The market center in Nanliu is rather deserted these days, the village chief conspicuous by his absence.

“At the height of the boom, the small farming community (of Nanliu) attracted attention from the local and international media, relishing its moment in the spotlight and a rare bit of good luck,” The Washington Post reported in August. “Now investors across the country are left wondering how what seemed like a sure thing so quickly turned into a suck on their life savings – and what the party leaders many trust might do about it.”

When the first drop in the market happened, many locals pulled out their money, but a few, like retired schoolteacher Nan Xinglao, found it difficult to forget the taste of fast money. Believing media reports that the crash was temporary, and that investors should remain patriotic, they thought they could recover what they’d lost. So they kept investing more money, but the steep drops after July ensured they’d all their life’s savings and ran into debts. One man claimed that he went broke after losing 210,000 yuan ($32,816).

Photo: Xinhua/Liu Xiao

Still, many of them hold on to the belief that things will go back to the way they were. Wang sometimes holds small gatherings at her grocery shop, believing that the market has bottomed out and it’s the right time to get back in. “The economy will move forward, not back,” she says with conviction. “It must.”

Sources: The Washington Post, CNBC,